All Categories

Featured

Table of Contents

- – What are the tax implications of an Annuities ...

- – How do Lifetime Income Annuities provide guara...

- – Where can I buy affordable Retirement Annuities?

- – Can I get an Tax-efficient Annuities online?

- – Why is an Immediate Annuities important for ...

- – What happens if I outlive my Immediate Annui...

Note, however, that this does not say anything about adjusting for inflation. On the plus side, even if you assume your alternative would certainly be to buy the securities market for those seven years, and that you would certainly obtain a 10 percent annual return (which is far from certain, especially in the coming years), this $8208 a year would certainly be greater than 4 percent of the resulting nominal stock value.

Instance of a single-premium deferred annuity (with a 25-year deferment), with 4 settlement options. The month-to-month payout here is highest possible for the "joint-life-only" option, at $1258 (164 percent higher than with the instant annuity).

The way you purchase the annuity will certainly determine the response to that question. If you get an annuity with pre-tax dollars, your costs reduces your taxed earnings for that year. According to , buying an annuity inside a Roth strategy results in tax-free settlements.

What are the tax implications of an Annuities For Retirement Planning?

The expert's very first step was to create an extensive monetary strategy for you, and afterwards clarify (a) exactly how the suggested annuity fits right into your overall plan, (b) what choices s/he taken into consideration, and (c) just how such alternatives would or would certainly not have caused reduced or higher payment for the expert, and (d) why the annuity is the premium option for you. - Annuity contracts

Obviously, an expert may attempt pushing annuities also if they're not the finest suitable for your circumstance and goals. The factor could be as benign as it is the only item they market, so they fall victim to the proverbial, "If all you have in your tool kit is a hammer, rather quickly whatever begins appearing like a nail." While the consultant in this circumstance might not be underhanded, it raises the danger that an annuity is a poor selection for you.

How do Lifetime Income Annuities provide guaranteed income?

Because annuities typically pay the agent selling them much higher payments than what s/he would certainly obtain for investing your cash in mutual funds - Annuity riders, not to mention the zero compensations s/he would certainly receive if you buy no-load shared funds, there is a large reward for representatives to press annuities, and the more difficult the better ()

A deceitful consultant recommends rolling that quantity right into new "better" funds that simply happen to bring a 4 percent sales lots. Accept this, and the advisor pockets $20,000 of your $500,000, and the funds aren't likely to execute far better (unless you picked even more improperly to start with). In the exact same example, the consultant might steer you to acquire a complicated annuity with that $500,000, one that pays him or her an 8 percent compensation.

The expert hasn't figured out just how annuity payments will certainly be tired. The consultant hasn't revealed his/her settlement and/or the fees you'll be charged and/or hasn't shown you the influence of those on your ultimate settlements, and/or the payment and/or costs are unacceptably high.

Your family history and current health factor to a lower-than-average life span (Lifetime payout annuities). Current rate of interest, and thus predicted payments, are traditionally low. Also if an annuity is ideal for you, do your due diligence in comparing annuities sold by brokers vs. no-load ones offered by the issuing business. The latter may need you to do even more of your own research study, or utilize a fee-based financial advisor who might receive compensation for sending you to the annuity provider, yet may not be paid a higher payment than for various other financial investment options.

Where can I buy affordable Retirement Annuities?

The stream of month-to-month settlements from Social Protection is comparable to those of a delayed annuity. Because annuities are voluntary, the individuals acquiring them typically self-select as having a longer-than-average life span.

Social Safety and security benefits are completely indexed to the CPI, while annuities either have no rising cost of living defense or at the majority of use an established percent annual increase that may or may not make up for rising cost of living in full. This sort of rider, similar to anything else that boosts the insurance company's risk, needs you to pay even more for the annuity, or accept lower payments.

Can I get an Tax-efficient Annuities online?

Please note: This post is planned for educational purposes only, and ought to not be considered economic advice. You ought to consult an economic specialist before making any type of major financial decisions.

Because annuities are planned for retired life, tax obligations and fines might use. Principal Security of Fixed Annuities. Never lose principal because of market efficiency as taken care of annuities are not bought the market. Even throughout market downturns, your cash will certainly not be influenced and you will not shed money. Diverse Investment Options.

Immediate annuities. Used by those that want reliable revenue promptly (or within one year of acquisition). With it, you can tailor revenue to fit your demands and develop revenue that lasts for life. Deferred annuities: For those who want to expand their money in time, yet agree to postpone access to the cash till retirement years.

Why is an Immediate Annuities important for my financial security?

Variable annuities: Provides greater capacity for growth by spending your cash in financial investment choices you pick and the ability to rebalance your portfolio based on your choices and in a method that straightens with changing monetary goals. With dealt with annuities, the company invests the funds and provides a rate of interest to the client.

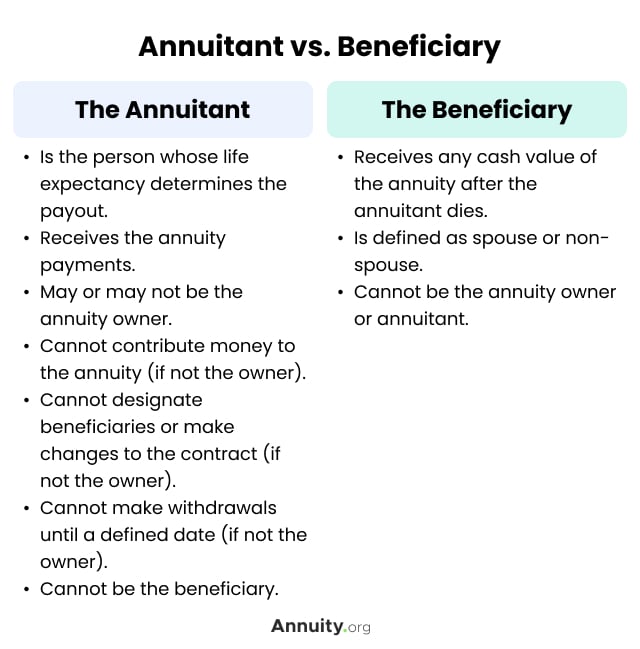

When a fatality case occurs with an annuity, it is essential to have actually a named beneficiary in the agreement. Various options exist for annuity death advantages, depending upon the contract and insurance firm. Choosing a refund or "period certain" option in your annuity provides a death benefit if you die early.

What happens if I outlive my Immediate Annuities?

Naming a recipient other than the estate can aid this procedure go a lot more smoothly, and can aid ensure that the profits go to whoever the specific wanted the cash to go to rather than going with probate. When present, a fatality advantage is immediately consisted of with your agreement.

Table of Contents

- – What are the tax implications of an Annuities ...

- – How do Lifetime Income Annuities provide guara...

- – Where can I buy affordable Retirement Annuities?

- – Can I get an Tax-efficient Annuities online?

- – Why is an Immediate Annuities important for ...

- – What happens if I outlive my Immediate Annui...

Latest Posts

What does an Guaranteed Return Annuities include?

How does an Lifetime Payout Annuities help with retirement planning?

Income Protection Annuities

More

Latest Posts

What does an Guaranteed Return Annuities include?

How does an Lifetime Payout Annuities help with retirement planning?

Income Protection Annuities