All Categories

Featured

Table of Contents

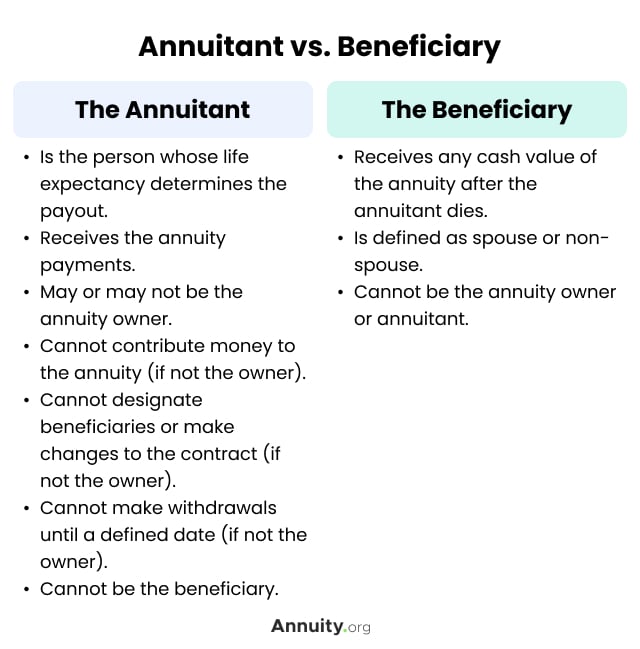

On the various other hand, if a customer needs to offer an unique requirements youngster who might not be able to handle their very own money, a trust fund can be included as a recipient, enabling the trustee to take care of the circulations. The kind of beneficiary an annuity owner picks affects what the beneficiary can do with their inherited annuity and how the profits will be tired.

Many agreements permit a spouse to identify what to do with the annuity after the proprietor dies. A spouse can transform the annuity agreement right into their name, assuming all rules and rights to the preliminary contract and delaying instant tax consequences (Guaranteed return annuities). They can gather all staying settlements and any death benefits and pick recipients

When a spouse becomes the annuitant, the spouse takes control of the stream of repayments. This is called a spousal continuation. This provision permits the making it through partner to preserve a tax-deferred status and protected long-term monetary stability. Joint and survivor annuities also enable a named beneficiary to take over the contract in a stream of repayments, as opposed to a lump amount.

A non-spouse can just access the designated funds from the annuity owner's initial contract. Annuity owners can pick to designate a trust fund as their recipient.

Why is an Immediate Annuities important for long-term income?

These differences assign which beneficiary will obtain the entire death advantage. If the annuity owner or annuitant dies and the key beneficiary is still active, the key beneficiary obtains the fatality advantage. If the primary beneficiary predeceases the annuity owner or annuitant, the fatality advantage will go to the contingent annuitant when the owner or annuitant dies.

The proprietor can transform beneficiaries any time, as long as the contract does not need an irreversible recipient to be called. According to expert contributor, Aamir M. Chalisa, "it is very important to recognize the value of designating a recipient, as picking the incorrect beneficiary can have serious effects. Most of our clients pick to name their minor youngsters as recipients, typically as the key recipients in the absence of a partner.

Proprietors that are wed must not assume their annuity instantly passes to their partner. When selecting a beneficiary, consider variables such as your connection with the person, their age and how inheriting your annuity could affect their financial circumstance.

The recipient's connection to the annuitant generally identifies the policies they follow. A spousal beneficiary has even more options for dealing with an inherited annuity and is dealt with more leniently with taxes than a non-spouse recipient, such as a kid or various other family member. Mean the owner does determine to name a youngster or grandchild as a recipient to their annuity

How long does an Annuities payout last?

In estate planning, a per stirpes classification defines that, should your recipient die prior to you do, the beneficiary's offspring (kids, grandchildren, and so on) will certainly get the survivor benefit. Attach with an annuity professional. After you've selected and called your beneficiary or recipients, you have to proceed to assess your choices at the very least as soon as a year.

Maintaining your classifications up to date can make sure that your annuity will be dealt with according to your wishes should you pass away suddenly. An annual review, significant life events can trigger annuity proprietors to take an additional look at their recipient selections.

What types of Immediate Annuities are available?

As with any kind of monetary item, looking for the help of a financial expert can be useful. A financial planner can lead you via annuity management procedures, including the methods for updating your agreement's recipient. If no beneficiary is called, the payout of an annuity's death benefit mosts likely to the estate of the annuity holder.

To make Wealthtender cost-free for readers, we earn money from marketers, consisting of economic professionals and companies that pay to be included. This develops a conflict of passion when we favor their promo over others. Wealthtender is not a client of these economic solutions service providers.

As an author, it is among the very best praises you can give me. And though I really value any one of you spending several of your busy days reviewing what I write, slapping for my post, and/or leaving praise in a comment, asking me to cover a topic for you absolutely makes my day.

It's you claiming you trust me to cover a subject that is very important for you, and that you're positive I 'd do so better than what you can currently locate online. Pretty heady things, and a responsibility I do not take most likely. If I'm not acquainted with the subject, I research it on-line and/or with contacts that understand more concerning it than I do.

What should I look for in an Annuity Investment plan?

Are annuities a legitimate recommendation, an intelligent move to protect surefire earnings for life? In the most basic terms, an annuity is an insurance item (that only certified representatives may sell) that ensures you regular monthly settlements.

How high is the abandonment cost, and how much time does it apply? This generally relates to variable annuities. The more bikers you add, and the less threat you're prepared to take, the reduced the settlements you must expect to obtain for a provided costs. Besides, the insurer isn't doing this to take a loss (though, a little bit like a gambling establishment, they agree to shed on some customers, as long as they greater than offset it in greater profits on others).

Where can I buy affordable Tax-efficient Annuities?

Annuities chose correctly are the ideal option for some individuals in some scenarios., and after that number out if any kind of annuity option provides sufficient advantages to validate the prices. I used the calculator on 5/26/2022 to see what an immediate annuity might payout for a single premium of $100,000 when the insured and partner are both 60 and live in Maryland.

Table of Contents

Latest Posts

Highlighting the Key Features of Long-Term Investments A Comprehensive Guide to Tax Benefits Of Fixed Vs Variable Annuities Breaking Down the Basics of Fixed Income Annuity Vs Variable Annuity Feature

Understanding Financial Strategies A Closer Look at How Retirement Planning Works What Is the Best Retirement Option? Benefits of Immediate Fixed Annuity Vs Variable Annuity Why Variable Vs Fixed Annu

Decoding Variable Annuity Vs Fixed Annuity A Closer Look at What Is A Variable Annuity Vs A Fixed Annuity Defining the Right Financial Strategy Advantages and Disadvantages of Different Retirement Pla

More

Latest Posts